capital gains tax proposal details

Raising the top marginal tax rate on individual income to 396 percent and applying an 8 percent surtax on MAGI above 25 million would bring the combined top marginal tax rate. Smaller corporations would fall.

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

. It would apply to those with more than 1 million in annual income. As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets. Though President Biden has proposed raising the corporate tax rate from 21 to 28 the proposal offers a more modest increase to 265.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. The key details of the plan are listed below. Bidens campaign proposal regarding capital gainsthe details.

Under current law such capital gains have a two-tiered structure. Individual Income Tax Changes Consolidates the current seven tax brackets into three with rates of 12 percent 25 percent. June 3 2021.

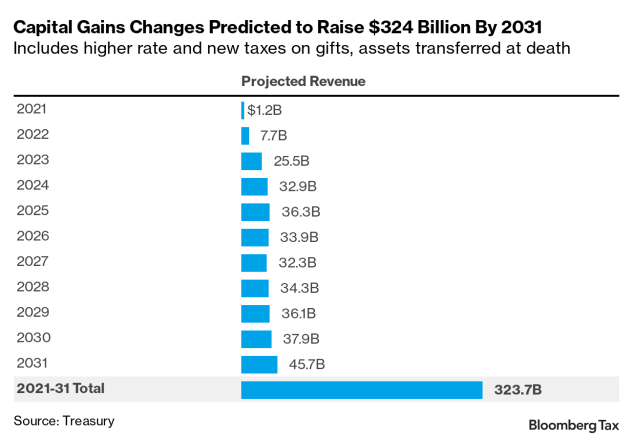

House Democrats proposed a top 25 federal tax rate on capital gains and dividends. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. Subscribe to receive email or SMStext notifications about the Capital Gains tax.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. President Donald Trump s main proposed change to. It would apply to single taxpayers with over 400000 of income and married.

Short-term gains face a top rate of 434 percent including the 396 percent statutory rate plus the 38 percent. Payroll Taxes Tax Expenditures Credits and Deductions Tax Compliance and Complexity Excise and Consumption Taxes Capital Gains and Dividends Taxes Estate and Gift Taxes Business. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent.

The House Ways Means Committee has released draft legislation of individual tax hikes they propose to pay for the 35 trillion social policy budget plan under consideration. If this happens it. The 486 rate includes a 38 net investment.

Taxpayers with an income of over 1M could lose their preferential 20 treatment on long-term capital gains. With this new plan that rate will increase to a whopping 396--nearly. Here are the details of Bidens plan to tax capital gains.

Would have the highest top capital-gains tax rates among OECD countries if President Bidens proposal were enacted. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax. President Biden in the recently-released Green Book has proposed far-reaching changes to the taxation of capital gains and the treatment of property that is.

Biden To Include Minimum Tax On Billionaires In Budget Proposal The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/9758221/picture1_24.png)

The Senate Republican Tax Plan Explained Vox

Biden Seeks Tax Hikes On Wealthy To Pay For Ambitious Families Plan

Capital Gains Tax In The United States Wikipedia

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Capital Gains Tax What Are They How To Avoid Them Youtube

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Wyden Fills In Details For Billionaires Income Tax Politico

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

How Are Capital Gains Taxed Tax Policy Center

Managing Tax Rate Uncertainty Russell Investments

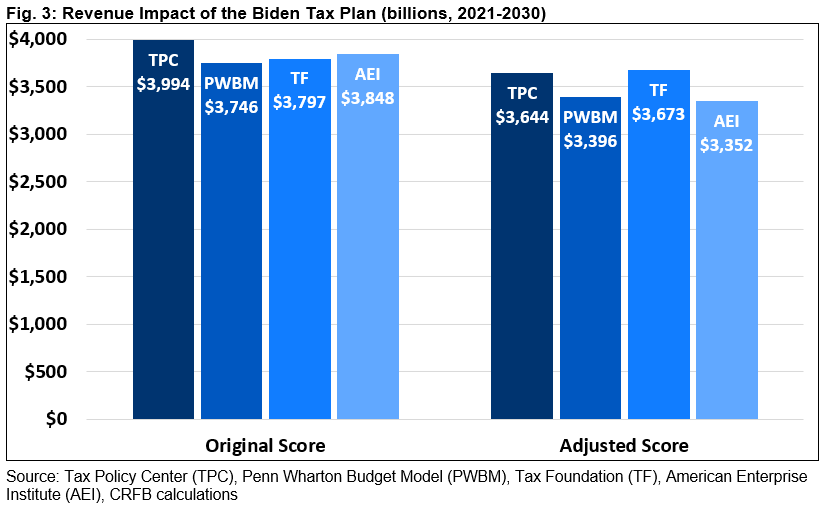

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

Capital Gains Full Report Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Biden S Capital Gains Tax Plan Would Push Us Rate To One Of Highest In Developed World Fox Business

Democrats Seek Backup Plan On Taxing Capital Gains Wsj

Democrats Float Partnership Buyback Taxes To Fund 3 5 Trillion Spending Plan Wsj

Tax Pros Perplexed By Scope Of Biden S Capital Gains Overhaul